Benefits

Benefits of Participating

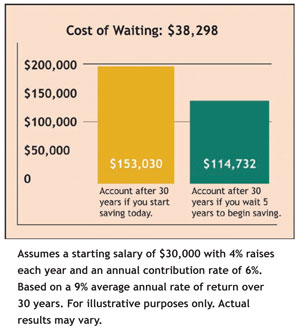

Whatever your age, it's crucial to organize your plans for retirement now and to put them into action without delay.

Consider this:

Just to maintain your same standard of living during retirement, you'll need as much as 80% of your final annual income for every year you're retired. And, to be on the safe side when you plan, it would be wise to count less on Social Security and other government support and rely more on your own efforts for financial security in retirement.

Save Now. Pay Taxes Later

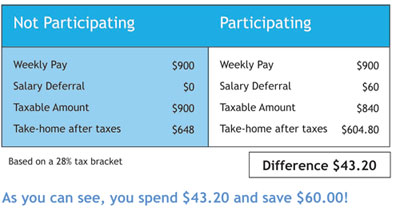

Convenient salary deferral contributions give you a systematic savings plan and an immediate tax break allowing you to keep more of what you earn.

Salary deferrals are your opportunity to save for retirement now and pay taxes later- when you withdraw your money. This deferred tax break is the government's way of encouraging you to save as much as you can today, so that you benefit over the long term.

As the example below shows, because your contributions are made on a pretax basis, the impact on your take-home pay is minimal.

403(b) Plan Savings Accumulate Faster

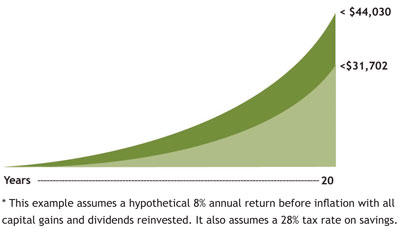

To see how a $60 weekly contribution would add up over the years, consider the following:

In just 20 years, savings in a tax-deferred 403(b) plan will outpace a taxable savings account by 30%! As you can see, the funds in your 403(b) account would total $153,930 compared to over $110,830 in the taxable account. *